About Us

Ramakrishnan Viraraghavan (RKV)

LLM (Edin), FCI Arb (London)

Ramakrishnan Viraraghavan (RKV) is a dual-qualified lawyer with 37 years of practice. He is renowned Supreme Court litigator. He is also a Barrister in the United Kingdom and practices both in India and United Kingdom. He is also an arbitrator in international commercial arbitrations.

Ramakrishnan is among the best tax lawyers in India. He started practice in tax and commercial litigation. RKV specializes in accounts, accounting standards, and corporate financial statements. He has rich experience in Income Tax, Central Excise, and Sales Tax matters as a top tax lawyer in India.

Viraraghavan has been time and again counted among the best Insolvency & Bankruptcy Lawyers in India and has successfully appeared in several precedent-setting matters. He regularly appears before the Supreme Court, National Company Law Tribunal, and National Company Law Appellate Tribunal, prosecuting and defending cases under the Insolvency and Bankruptcy Code for petitioning creditors, corporate debtors, resolution applicants, and resolution professionals as an insolvency litigation lawyer.

He has also advised in the voluntary winding up of companies; advised companies and obtained approvals on reduction of share premium, share capital & other forms of corporate re-structuring, including arrangements with creditors; appeared in mergers, amalgamations, and de-mergers, reorganizations relating to more than 300 companies; advised and appeared in matters on IPOs, buy-back, SEBI, and stock exchange related issues.

“For a long time, I have known that the key to getting started down the path of being remarkable in any thing is to simply act with the intention of being remarkable”Tim Ferriss

“Great acts are performed not through strength but by perseverance”Samuel Johnson

PRACTICE AREAS

Banking & Finance

Banking

& Finance Litigation practice is backed by

comprehensive expertise and decades of

experience.

Civil & Commercial Litigation

Mr

Viraraghavan is highly skilled in handling

commercial litigation cases before the Supreme

Court,

Company & Partnerships

Mr

Viraraghavan has extensive experience in company law

matters. He advises clients on company petitions for

oppression

IBC and Commerical Litigation

At the

Chambers of Ramakrishnan Viraraghavan, our

distinguished senior counsel specialises in

providing comprehensive legal solutions

Corporate Insolvency Resolution

Mr

Viraraghavan is a trusted advocate in the Insolvency

and Bankruptcy Code matters.

Criminal Litigation

At the

Chambers of Ramakrishnan Viraraghavan, our criminal

litigation practice is marked by meticulous case

handling and comprehensive

representation.

Direct & Indirect Taxes

Tax laws

encompass both direct and indirect tax implications,

and Mr. Viraraghavan guides clients in understanding

and complying with direct tax regulation

Insurance Litigation

Insurance litigation is the legal

process by which insurers and policyholders dispute

the meaning and interpretation of an insurance

policy.

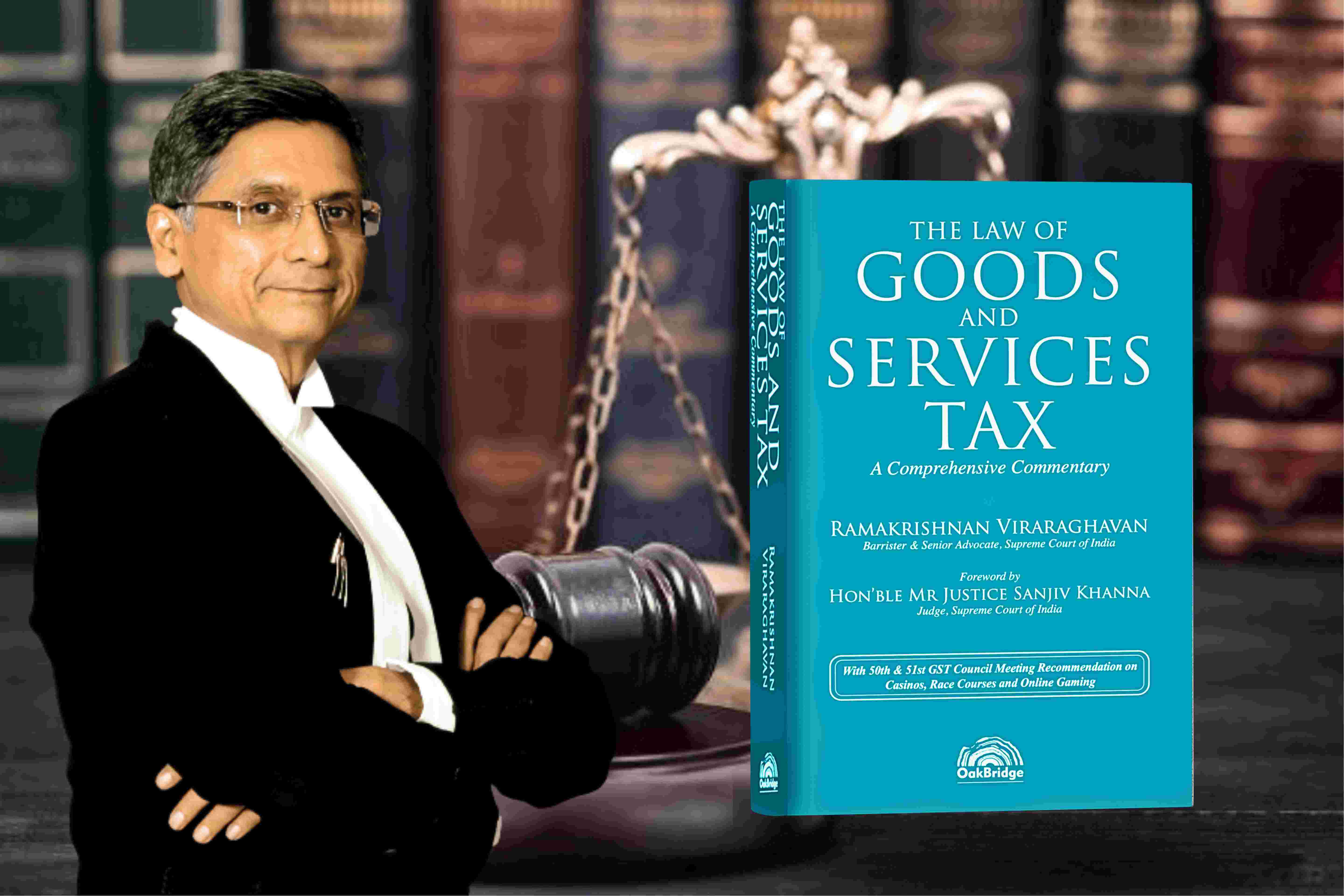

Book Endorsement

Events

-

4th Annual BW Legal Global Legal Summit & Legal Leader Awards

.jpg)

Date - 2023-06-24

BW Legal World hosted an event in Legal Global Summit on 24th June 2023 in Imperial Hotel, New Delhi.

Mr. Ramakrishnan Viraraghavan, Barrister -

Ramakrishnan Viraraghavan in a fireside chat with Justice Mr. Hemant Gupta (Retd.) at Charted Institute of Arbitrators Annual Conference 2023

Date - 2023-07-15

Charted Institute of Arbitrators organised an event in Lalit Hotel, New Delhi on 15th July 2023 on ‘Corporate Dispute Resolvers: The Role of General Counsel, Professionals & the Industry.’

-

National Judical Academy

Date - 2023-04-03

The National Judicial Academy (NJA), Bhopal is an institution which is little-known outside the justice delivery system. It is an institution established to strengthen the administration of Justice th

-

Highlights from the TIOL PRIVATE LIMITED Tax Congress 2023

Date - 2023-10-04

On October 4th, 2023, the TIOL PRIVATE LIMITED Tax Congress 2023 took place, organized by Mr. Shailendra Kumar, Chairman of the TIOL KNOWLEDGE FOUNDATION. The Congress assembled key stakeholders in t